Understand the big picture

By clarifying your goals

This might be the hardest part. Prioritizing your goals gets you buzzing about what your money can do. It also helps guide your savings plan, as throwing money into a generic savings account isn't exactly the most imaginative experience. Whether it's buying a home or starting up a side hustle - having clear goals will help direct your investing strategy.

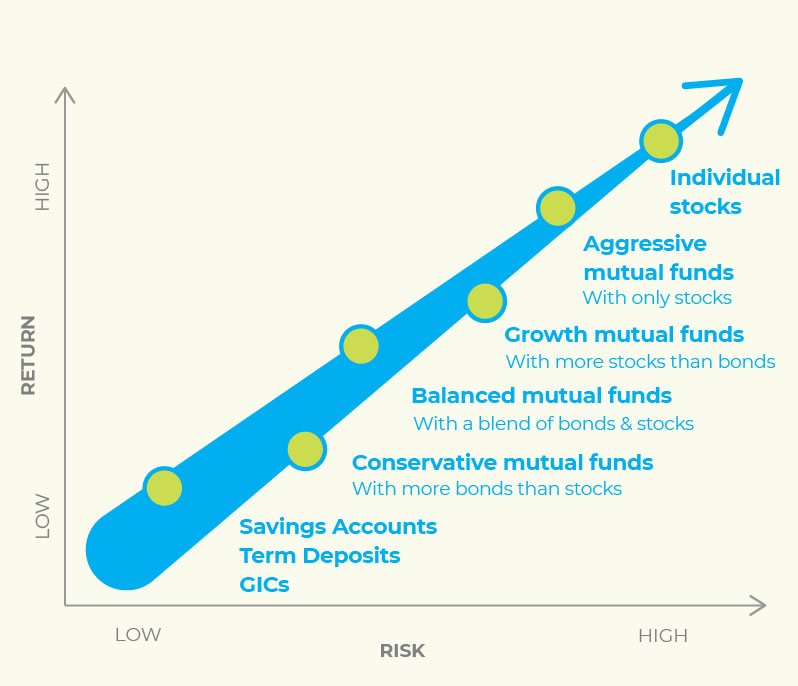

How risky is it?

Different investments offer varying degrees of risk

All investments sit on a spectrum of risk. A low-risk investment is more predictable, whereas a high-risk investment means you have the ability to earn more but also have the potential of loss.- Stocks: historically, the highest short-term risk but the highest long-term returns

- Bonds: generally less volatile than stocks, but deliver more modest returns

- Cash and cash-equivalents (short term GICs or term deposits, T-bills, money market instruments): the safest investments, but offer the lowest returns

Get started

With a registered savings plan

Opening a registered savings account is a great way to start up your investing journey. Each one of these acts as a savings "bucket" where you can choose to simply save your money (with tax benefits) or invest it in a variety of ways.

Choose the savings plan right for you. >

Tools & Resources

Holistic planning for everyone, including new investors

Perfect if you want to:

-

Set clear savings goals or adjust your savings plan

-

See more growth or learn about investing

-

Benefit from investing based on your risk tolerance

Planning for experienced investors, with 100K+ in assets

Perfect if you want to:

-

Provide a legacy for your children, grandchildren, or favourite cause

-

Support complex tax planning

-

Maximize the return on your investments

Expand and grow your investments

Perfect if you want to:

-

Plan for retirement or other long-term goals, with confidence

-

Leverage tax-efficient savings strategies

-

Save smarter for your first home