CREDIT CARD

How do I link my SASCU Collabria Mastercard?

There are two ways you can link a card:

- from the Account Summary page by looking under the Collabria Credit Cards header and clicking 'Link Accounts'.

- or from the side bar navigate to 'Account Services', 'Manage Partner Accounts', Add/Remove Collabria Accounts and click 'Link a Credit Card'.

Note the initial setup of Manage Partner Accounts cannot be completed on a mobile device; however, once the setup has been completed on a computer it can then be accessed on a mobile device by clicking on full site or accessing the SASCU app.

Can I link more than one card?

Yes – so long as you are the primary cardholder, you can link more than one SASCU Collabria Mastercard.

To add another card navigate to 'Account Services', 'Manage Partner Accounts', Add/Remove Collabria Accounts and click 'Link a Credit Card'.

What is a primary SASCU Collabria Mastercard?

A primary SASCU Collabria Mastercard is issued to the person who applied for the credit card and is responsible for the payment of credit advances made on the card.

Can I link my business SASCU Collabria Mastercard?

Yes. Collabria allows linking of a primary business credit card to a Personal account, if the Online Banking user and cardholder are the same person. Secondary business Collabria credit cards cannot be linked.

Can I link my SASCU Collabria Mastercard in Small Business Online Banking?

No. Collabria is only available for Personal accounts and not available for Small Business Online Banking.

Can I view transactions of my linked SASCU Collabria Mastercard card right away?

You can view all past transactions right away. Any pending transactions within 24 hours may not be shown.

What happens if I can’t view my Collabria credit card transactions?

If you can’t see the transactions and the card has been linked, you may have no actual transactions that occurred, or transactions may be pending for the card and thus have not shown in transactions.

It could also be an error connecting to Collabria services and you can try again later. If the issue persists, call the Collabria support line.

How can I use single sign on?

- Login to online banking

- Link a partner account (Collabria or Qtrade; Credential is unavailable for Single Sign On)

- Click ‘View’ and be automatically taken to the partner account already logged in

Pre-conditions for Single Sign on to work:

- at least one Collabria card or Qtrade account is linked to the account

- browser's pop-up blocker is disabled for the online banking site

QTRADE

How do I set up my Qtrade account?

There are two ways you can link a Qtrade account:

- from the Account Summary page by looking under the 'Credential Accounts' header and clicking 'Link Accounts'.

- or from the side bar by navigating to 'Account Services', 'Manage Partner Accounts', and clicking 'Link an Investment Account'.

Note the initial setup cannot be completed on a mobile device; however, once the setup has been completed on a computer it can then be accessed on a mobile device by clicking on full site or the SASCU app.

How do I know if my account was linked successfully?

Balances will show under your SASCU accounts. You’ll also receive a confirmation email from Qtrade.

How current are the Qtrade holdings being displayed on my Account Summary page?

Like Credential, holdings being displayed may have a 1-2 day delay. You can see when the holdings were updated under the “As of” tab in Online Banking.

Can I link a spouse's Qtrade account?

No. Only your Qtrade account can be linked.

How can I use single sign on?

- Login to online banking

- Link a partner account (Collabria or Qtrade; Credential is unavailable for Single Sign On)

- Click ‘View’ and be automatically taken to the partner account already logged in

Pre-conditions for Single Sign on to work:

- at least one Collabria card or Qtrade account is linked to the account

- browser's pop-up blocker is disabled for the online banking site

CREDENTIAL

How do I link my Credential® account?

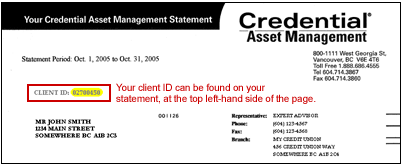

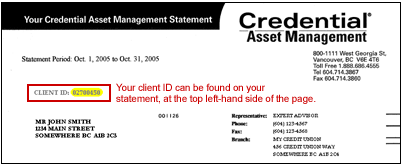

Navigate to ‘Manage Partner Accounts’. Select “Credential Asset Management Inc.”. Enter your Client ID number. Your last name, postal code, and date of birth should pre-populate automatically and match your Credential records.

Where do I find my Credential® client number or client ID?

Your Credential client information can be found on your Credential statement.

How current are the Credential holdings being displayed on my Account Summary page?

Holdings being displayed may have a 1-2 day delay. You can see when the holdings were updated under the “As of” tab in Online Banking.

Can I link accounts owned by an organization?

No, only personal accounts can be linked at this time.

Can I link both my sole and joint Credential Direct® Accounts?

No, you can only link either your sole OR your joint accounts, not both.

Why isn’t my Credential account linking?

There are a couple reasons your account might not link:

- Make sure your postal code and last name match Credential’s records

- Make sure there aren't any spaces at the end of your client ID

GENERAL

Is Manage Partner Accounts available on the Mobile App?

Yes, Manage Partner Accounts is available in the SASCU Mobile App. You can view account summaries and transactions. You can only link partner accounts through online banking on a computer.

How current are the displayed partner account holdings?

Qtrade and Credential have a 1-2 day delay. You can see when the holdings were updated under the “As of” tab. SASCU Collabria Mastercard’s show past transactions right away; pending transactions can take up to 1 day to display.

Remember you can use single sign on for Qtrade and Collabria. There’s also a link to Credential, however, you’ll be asked to login to your Credential account.

Can I unlink an individual account held with one of the financial partners?

No. When you remove a partner account, all of the accounts held under it will be removed also.

What internet browsers are compatible with Manage Partner Accounts?

Our provider support Edge, Firefox, Safari, and Chrome. Other browsers may work, but are not officially supported.

Note the initial setup cannot be completed on a mobile device; however, once the setup has been completed on a computer it can then be accessed on a mobile device by clicking on full site.

My accounts are successfully linked but the information is not displaying in online banking. What can I do?

- Log out and log back in.

- Clear your browser cache (cookies).

My single sign-on isn't working. What can I do?

Make sure:

- at least one Collabria card or Qtrade account is linked to the account

- the browser's pop-up blocker is disabled for the online banking site

My SASCU Collabria Mastercard won't link.

For your card to link, you must be the primary account holder.