With self-serve application forms, you can quickly submit your details for loans, deposits, and more—hassle-free and on your own schedule.

Forms include:

Visit our Self-Serve Applications page to learn more.

Consider this your one-stop-shop for all of SASCU's latest changes to online banking.

Looking for more resources? Click here for video tutorials, tools and calculators and more.

February 5, 2025

Take control of your SASCU debit card with Lock’N’Block – a card lock feature to safeguard your debit card with a simple user experience.

Available to all SASCU members via online banking and our mobile apps, Lock'N'Block enables you to block debit card transactions anytime, anywhere.

Check out the video tutorials below for step-by-step instructions on how to use it.

With self-serve application forms, you can quickly submit your details for loans, deposits, and more—hassle-free and on your own schedule.

Forms include:

Visit our Self-Serve Applications page to learn more.

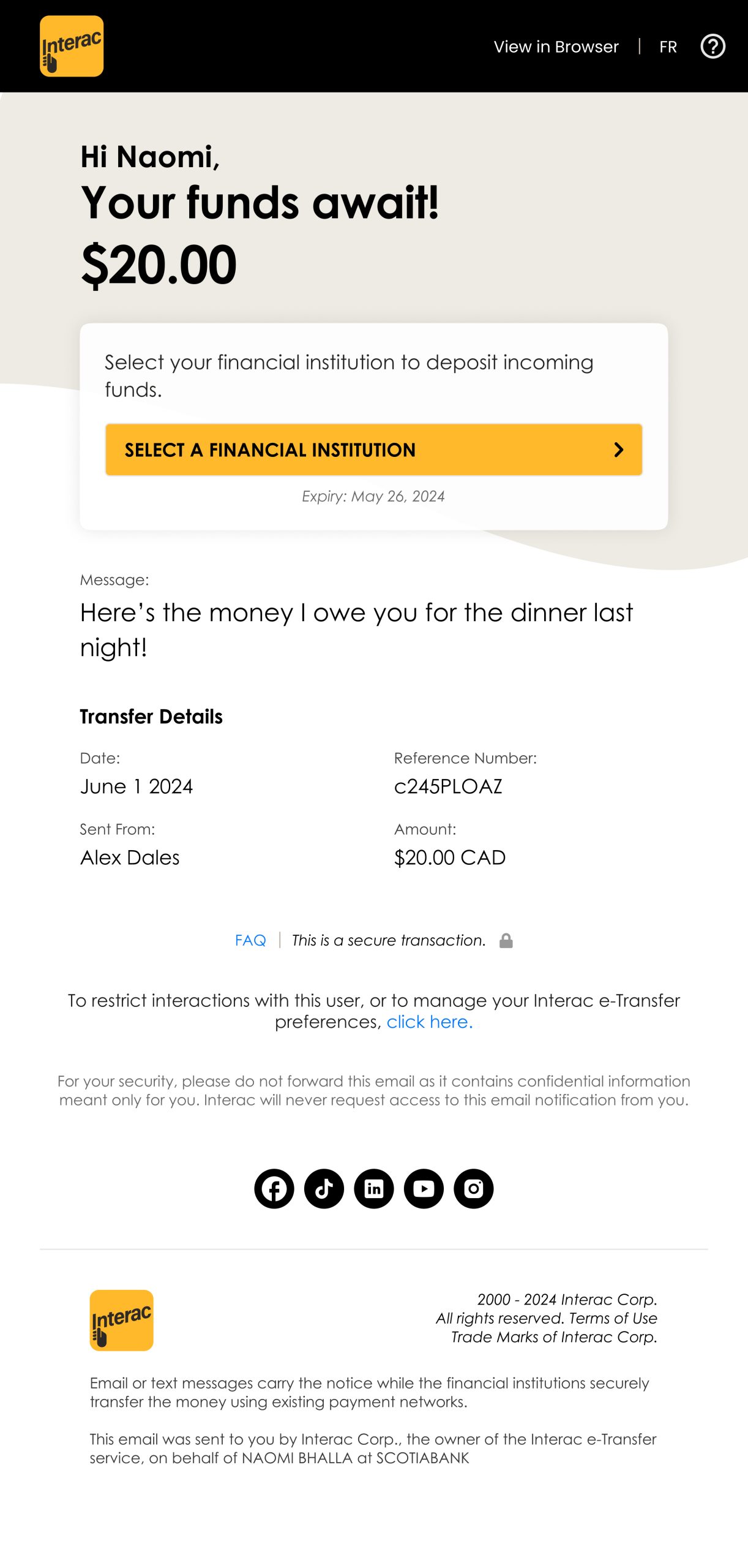

Interac is updating the design of its e-Transfer® email notifications, effective October 22.

This visual change will impact both receive and send notifications, as well as notifications for Autodeposit and Request Money. On this page, you can view a preview of the updated notification.

This feature is for Personal SASCU accounts. Small Business Online Banking won't have the option to schedule or send recurring e-Transfers.

Set up a Scheduled/Recurring e-Transfer in the SASCU App:

Online Banking steps:

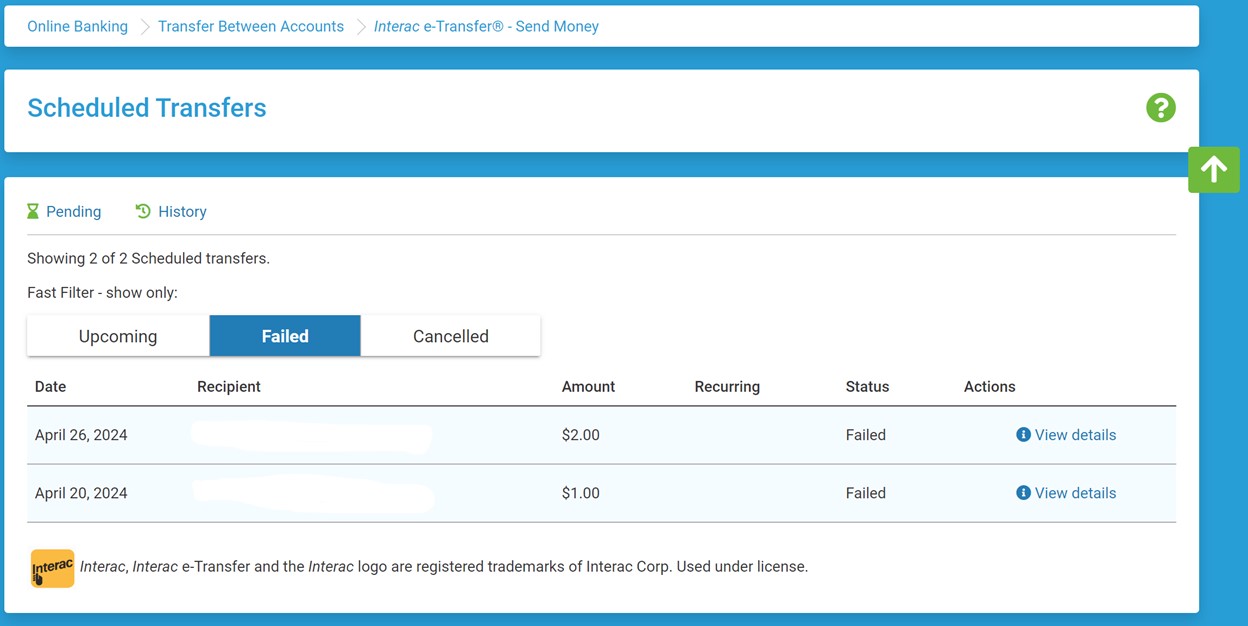

After logging into Online Banking, click Transfers > Scheduled/Recurring then Pending. See upcoming transfers under Scheduled and past transfers under History.

In our app navigate to Interac e-Transfer® > Send Money, then Pending.

Note: Failed e-Transfers show in Scheduled under the ‘Failed’ tab, they do not appear in e-Transfer History.

Like regular e-Transfers or scheduled bill payments, there are several reasons a transfer may have failed:

If the first e-Transfer failed due to insufficient funds, you will need to place more funds in the account otherwise the rest will fail. Note: Like scheduled bill payments, scheduled e-Transfers will not ‘re-try’ sending a transfer. If it fails, it remains failed and advances to the next date.

If an e-Transfer fails, give us a call (250.832.8011) and we'll have a look to see why it might not have gone through.

Recurring and scheduled Interac e-Transfers®, like regular e-Transfers, are FREE. Just another perk of being a SASCU member!

Link your SASCU credit card and debit cards to Mobile Wallet and enjoy hassle-free shopping anytime, anywhere.

Mobile Wallet is easy to use, offers contactless payments, and has purchase and fraud protection. Saving room in your wallet has never felt better. Set up your SASCU credit card and debit card today.

We use cookies to enhance your browsing experience, keep your online banking session secure, and provide relevant content. We never store personal or financial information in our cookies. By continuing the use of our website, you agree to the use of our cookies. For more details, read our full Privacy Policy.

We use cookies to enhance your browsing experience, keep your online banking session secure, and provide relevant content. We never store personal or financial information in our cookies. By continuing the use of our website, you agree to the use of our cookies. For more details, read our full Privacy Policy.

every step of the way.